Benjamin Franklin Predicted Stablecoins (And Why the GENIUS Act Proves Him Right)

From colonial paper currency to digital dollars: How Franklin's 296-year-old monetary insights explain everything about the Senate's historic stablecoin legislation

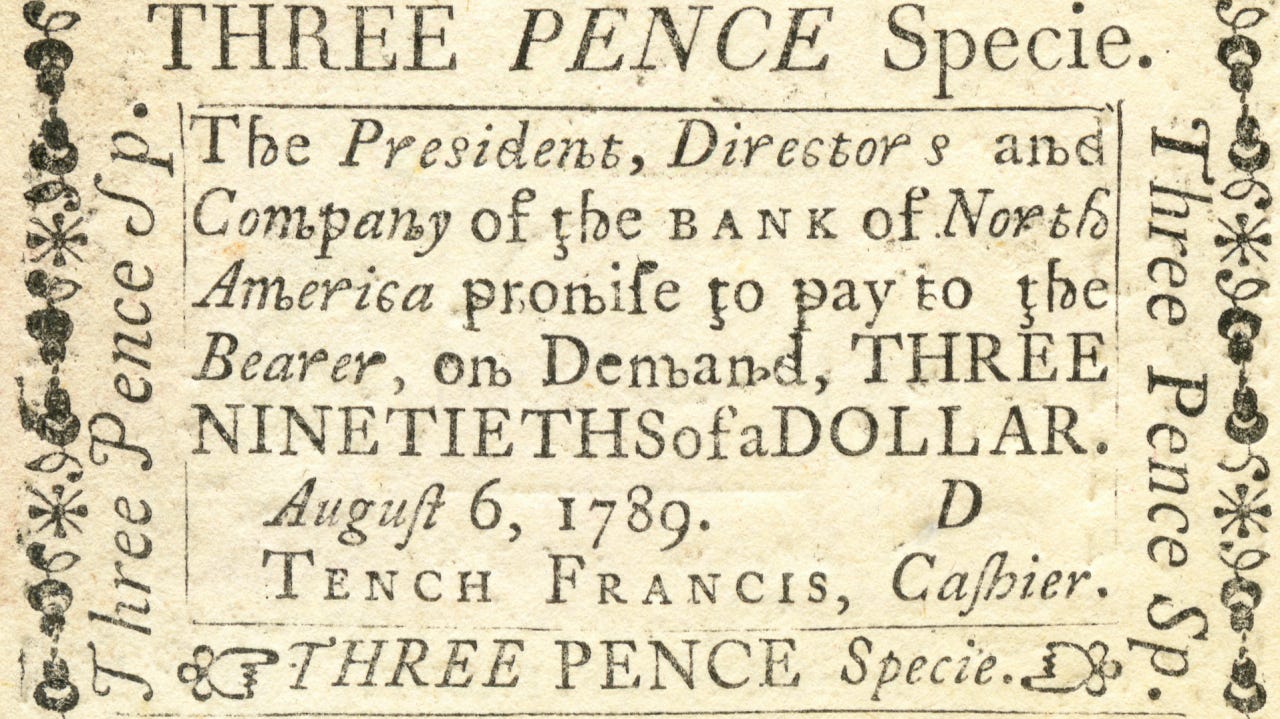

When Benjamin Franklin penned "A Modest Enquiry into the Nature and Necessity of a Paper Currency" in 1729, he couldn't have imagined blockchain technology or digital assets. Yet his revolutionary insights about controlled money supply, decentralized commerce, and the relationship between innovation and regulation predicted almost exactly what happened when the U.S. Senate passed the GENIUS Act 68-30 in June 2025.

The legislation—formally known as the Guiding and Establishing National Innovation for U.S. Stablecoins Act—establishes the first comprehensive federal framework for stablecoins, digital currencies pegged to the U.S. dollar. With the stablecoin market now approaching $232 billion and accounting for the majority of on-chain transaction volume, Franklin's 296-year-old monetary theories have never been more relevant.

Franklin's Revolutionary Vision: Money as Technology

In colonial Pennsylvania, Franklin faced a problem that sounds remarkably familiar to today's crypto advocates: regulatory uncertainty stifling innovation. The colony suffered from a severe shortage of hard currency, hampering trade and economic growth. Traditional banking establishments resisted change, preferring the status quo that benefited existing power structures.

Franklin's solution was radical for its time: paper currency backed by land and precious metals, issued not by distant European powers but by local colonial authorities who understood regional commerce. His printing network—one of America's first examples of decentralized infrastructure—spread this innovation across the colonies using consistent standards and quality controls.

"The riches of a country are to be valued by the quantity of labor its inhabitants are able to purchase," Franklin wrote, arguing that controlled money supply could stimulate trade when hard currency was scarce. Replace "labor" with "digital transactions" and "hard currency" with "traditional payment rails," and Franklin could be describing the value proposition of stablecoins in 2025.

The GENIUS Act: Franklin's Principles in Digital Form

The Senate's passage of the GENIUS Act represents the first time Congress has created comprehensive federal guardrails for dollar-pegged stablecoins. The legislation grants sweeping authority to Treasury Secretary Scott Bessent, who recently testified that the U.S. stablecoin market could grow nearly eightfold to over $2 trillion in the coming years.

The Act's key provisions would have made perfect sense to Franklin:

Controlled Issuance with Real Backing: Just as Franklin insisted colonial paper currency be backed by tangible assets, the GENIUS Act requires full reserve backing and monthly audits. Stablecoin issuers must hold actual dollars or Treasury securities equal to every digital token in circulation—Franklin's "sound money" principle encoded in law.

Decentralized but Standardized Network: Franklin succeeded because his printing network used consistent fonts, paper quality, and security features across different colonies. The GENIUS Act creates similar interoperability standards, ensuring different stablecoins work together while opening issuance to banks, fintechs, and qualified retailers—not just tech giants.

Consumer Protection Priority: The legislation mandates that stablecoin holders get priority repayment in bankruptcy proceedings and requires compliance with anti-money laundering rules. Franklin, who saw firsthand how monetary instability hurt ordinary colonists, would appreciate these consumer safeguards.

Innovation Within Guardrails: Perhaps most importantly, the Act balances innovation with oversight. While it prohibits unregulated issuance, it creates clear pathways for qualified entities to launch stablecoins—much like Franklin advocated for regulated but accessible paper currency.

The Politics of Monetary Innovation: Then and Now

Franklin navigated fierce political opposition to his paper currency proposals, much like crypto advocates faced during the GENIUS Act's tortuous path to passage. The bill was supposed to be the "easiest" crypto legislation to pass, yet as Senator Cynthia Lummis noted at Bitcoin 2025, "It has been extremely difficult. I had no idea how hard this was going to be."

The colonial monetary debates and today's crypto politics share striking parallels. In both eras, entrenched interests resisted change while innovators argued that new monetary technologies could expand economic opportunity. Franklin faced criticism from merchants who profited from currency scarcity; today's crypto legislation encounters resistance from traditional financial institutions and policymakers concerned about disruption.

Notably, the GENIUS Act includes provisions that would have resonated with Franklin's political pragmatism. The legislation prohibits Congress members from issuing stablecoins during their service—a conflict-of-interest safeguard that acknowledges the power of monetary innovation. However, it doesn't restrict presidential involvement, reflecting the complex politics surrounding President Trump's World Liberty Financial venture, which issued the USD1 stablecoin earlier this year.

Beyond Stablecoins: The Infrastructure Play

Franklin understood that successful monetary innovation required more than just new currency—it demanded supporting infrastructure. His printing network, postal system, and business partnerships created an ecosystem that made paper currency practical for everyday commerce.

The GENIUS Act takes a similar systems approach. While focused on stablecoins, the legislation lays groundwork for broader digital asset integration into traditional finance. Major retailers like Amazon and Walmart are reportedly exploring stablecoin-style offerings, recognizing that programmable money could revolutionize payment networks just as Franklin's paper currency transformed colonial trade.

For Bitcoin and crypto builders, the Act offers particular advantages. Unlike some regulatory proposals that treat all digital assets suspiciously, the GENIUS Act specifically protects "organically launched protocols" like the Lightning Network, Ordinals, and RGB smart contracts. Franklin would appreciate this nuanced approach—supporting innovation while addressing legitimate regulatory concerns.

The Global Competition Franklin Predicted

Franklin's monetary theories weren't just about Pennsylvania—they were about American economic independence. He recognized that monetary sovereignty was essential to political sovereignty, warning against dependence on foreign financial systems.

Today's stablecoin race carries similar geopolitical implications. The GENIUS Act aims to ensure dollar dominance in digital currency markets, but it must compete against China's digital yuan and European Union regulatory frameworks. Franklin would likely support the Act's provisions requiring foreign stablecoin issuers to comply with U.S. court orders and agency actions—financial sovereignty through technological leadership.

The legislation's emphasis on keeping "innovation on shore"—as Senator Kirsten Gillibrand put it—echoes Franklin's belief that monetary innovation drives broader economic development. Just as colonial paper currency helped build American commercial independence, regulated stablecoins could cement dollar dominance in the emerging digital economy.

What Franklin Would Worry About

Despite supporting the GENIUS Act's core principles, Franklin's practical wisdom would likely identify potential concerns. The legislation creates what critics call a "Tether loophole," allowing some offshore issuers to continue operating with less oversight. Franklin, who emphasized the importance of uniform standards, might question whether this regulatory arbitrage could undermine the framework's effectiveness.

The Act's complexity—running hundreds of pages with intricate federal-state regulatory coordination—might also concern Franklin, who preferred elegant solutions. His paper currency proposals succeeded partly because they were simple enough for ordinary colonists to understand and use.

Most significantly, Franklin might worry about the concentration of authority in federal agencies. While he supported regulation, Franklin believed in distributed power and local knowledge. The GENIUS Act's centralized approach, while necessary for modern global finance, represents a more top-down model than Franklin typically favored.

The House Decision: Completing Franklin's Vision

With the Senate passage behind it, the GENIUS Act now moves to the House of Representatives, where a companion bill—the STABLE Act—awaits consideration. The political dynamics mirror Franklin's era: innovators pushing for clarity and opportunity, traditionalists concerned about stability and control.

Franklin succeeded because he built coalitions across political divides, emphasizing shared benefits rather than partisan differences. The GENIUS Act's bipartisan Senate support—including 18 Democrats joining all Republicans—suggests similar coalition-building success.

House Financial Services Committee Chairman French Hill has signaled willingness to move forward, and President Trump has indicated support for stablecoin legislation. The question isn't whether Congress will act, but whether it will embrace Franklin's full vision of monetary innovation within appropriate guardrails.

The Future Franklin Imagined

"An investment in knowledge pays the best interest," Franklin famously observed. The GENIUS Act represents exactly that kind of investment—using historical wisdom to guide technological innovation toward productive ends.

Franklin understood that money is ultimately technology, technology creates power, and power requires responsible governance. His paper currency experiments succeeded because they balanced innovation with accountability, local knowledge with broader standards, and economic opportunity with consumer protection.

The GENIUS Act, for all its complexity and compromises, embodies these same principles in digital form. Whether Congress completes Franklin's vision depends on recognizing what the founding father understood in 1729: monetary innovation isn't just about finance—it's about building the infrastructure for economic freedom and prosperity.

As Franklin might say today, "The future of money is being written NOW." The question is whether America will lead that writing or let others hold the pen.

BlockSkunk analyzes the intersection of historical precedent and cutting-edge blockchain development. For more insights on crypto and blockchain innovation, follow our research at blockskunk.com, or on X at https://x.com/blockskunk